The Main Street Employers Coalition joined with over 40 national organizations in support of H.R.…

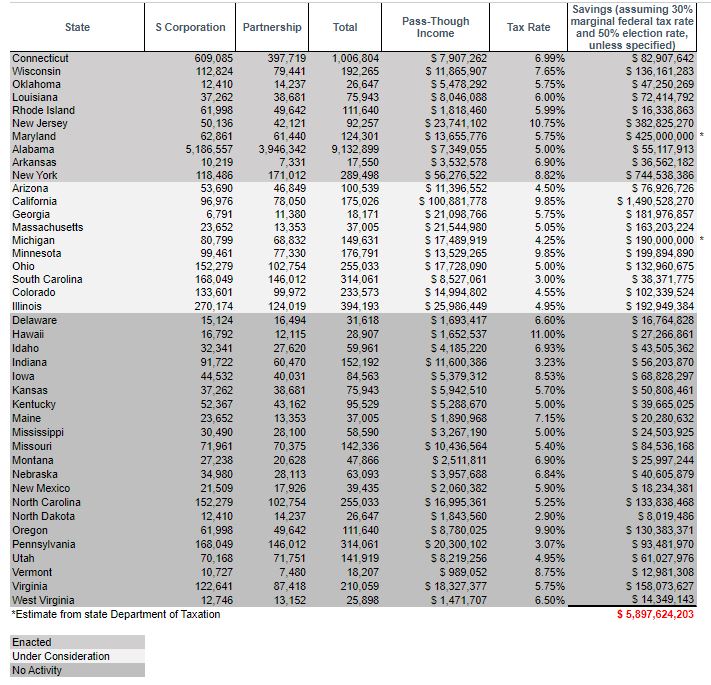

Estimated SALT Parity Relief by State

Of the 41 states that tax pass-through businesses at the owner level, more than half have either adopted our SALT Parity reform or are actively considering it.

This is a big deal to the S corporations and partnerships in those states. The disparate SALT treatment they experience puts them at a significant disadvantage compared to their C corporation competitors and compared to entities operating in states with no income tax, like Texas and Florida.

Billions are at stake. Using IRS data and the fiscal notes published by other state revenue agencies, we roughly estimate that more than three million S corporations and partnerships would benefit from $5.9 billion in annual relief. Click the image below for a full table outlining our estimates: